In recent years, carbon taxes have emerged as a prominent strategy for addressing climate change and curbing greenhouse gas emissions. This article delves into the impact of carbon taxes on the Oil Era, an oil trading platform, analyzing how these taxes shape the dynamics of the oil market and influence the behavior of market participants. By exploring the effects of carbon taxes, we can gain valuable insights into the transformative role these taxes play in shaping the future of the oil industry and its transition toward a more sustainable energy landscape. Diversify your portfolio and start trading oil using oilprofit.app, a modern-day oil trading platform.

Understanding Carbon Taxes

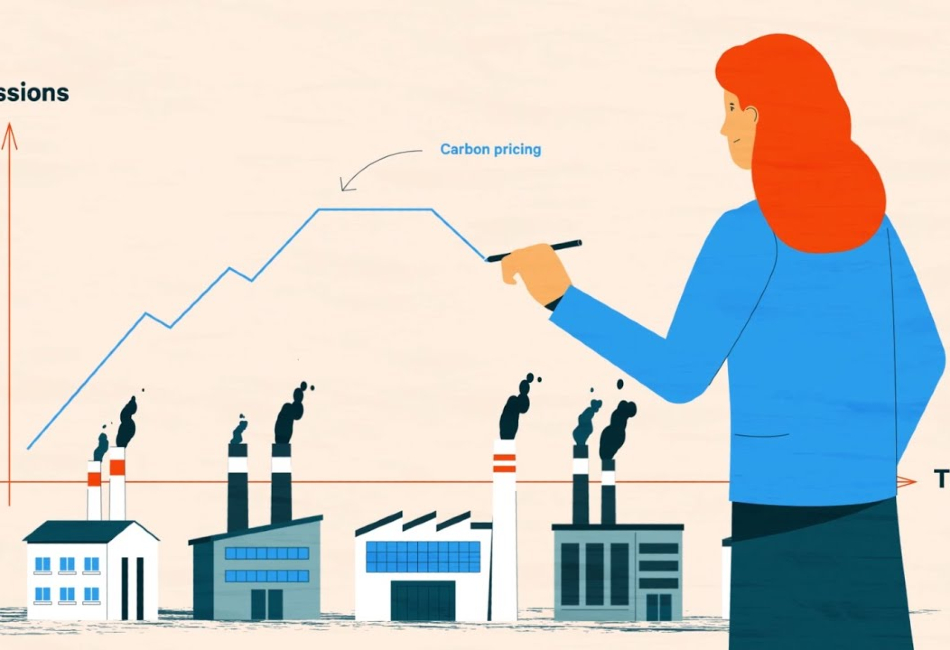

A carbon tax is a financial levy imposed on the carbon content of fossil fuels, such as oil, coal, and natural gas. Its purpose is to internalize the external costs linked to carbon emissions by increasing the cost of consuming these fuels. By making fossil fuel consumption more expensive, the carbon tax aims to incentivize individuals and businesses to shift towards cleaner energy sources. The revenue generated from carbon taxes can be reinvested in renewable energy projects, and environmental initiatives, or used to offset other taxes, providing opportunities to foster sustainable practices and support a transition to a low-carbon economy.

Shifting Dynamics in the Oil Market

- Reduced Demand: The implementation of carbon taxes leads to an increase in the price of oil, making alternative energy sources relatively more attractive. As a result, the oil demand may decrease, especially in industries that can easily transition to cleaner energy alternatives.

- Investment in Clean Technologies: Carbon taxes incentivize companies to invest in research and development of cleaner technologies, such as renewable energy, electric vehicles, and energy-efficient solutions. This shift in focus could lead to reduced reliance on oil and a diversification of energy sources.

- Changing Consumer Behavior: Higher oil prices resulting from carbon taxes can encourage consumers to adopt more energy-efficient practices, such as using public transportation or opting for electric vehicles. This behavioral change can further impact the demand for oil and shape market dynamics.

Market Participants’ Response

- Oil Producers: Carbon taxes can pose challenges for oil producers, especially those heavily dependent on high carbon-intensive extraction methods. These producers may face increased costs, reduced profit margins, and pressure to explore cleaner production methods. However, carbon taxes also provide an opportunity for oil producers to invest in renewable energy projects and transition towards sustainable practices.

- Oil Traders: Carbon taxes introduce additional complexity and risk into the oil trading market. Traders need to account for the varying carbon tax levels across different regions and adjust their strategies accordingly. This can lead to shifts in trading patterns, with a potential decrease in trading volumes for carbon-intensive oil and an increase in demand for low-carbon alternatives.

- Consumers and End Users: Carbon taxes indirectly affect consumers and end users through changes in oil prices. Higher oil prices resulting from carbon taxes can impact transportation costs, heating expenses, and the prices of goods and services reliant on oil. However, it also encourages consumers to explore energy-efficient alternatives, contributing to a greener and more sustainable future.

International Implications

- Competitiveness of Oil Exporting Nations: Carbon taxes implemented by certain countries can influence the competitiveness of oil exporting nations. Higher taxes can make their oil products relatively more expensive compared to countries with lower or no carbon taxes. This could potentially impact trade relationships, market shares, and the global oil landscape.

- Global Emissions Reduction: Carbon taxes play a crucial role in global efforts to reduce greenhouse gas emissions. By incentivizing the transition to cleaner energy sources, these taxes contribute to mitigating climate change and achieving environmental targets outlined in international agreements like the Paris Agreement.

Conclusion

Carbon taxes wield considerable influence over the oil trading market, exerting profound effects on its dynamics and participant behavior. These taxes, which raise the cost of oil consumption and drive the advancement of cleaner technologies, play a crucial role in the global endeavor to combat climate change. As governments across the globe increasingly consider and adopt carbon tax policies, the oil industry is compelled to adapt and innovate, embracing sustainability as a prerequisite for success in an evolving energy landscape. By recognizing the transformative potential of carbon taxes, the oil industry can navigate these changes, proactively embrace renewable energy solutions, and contribute to a more sustainable future.